Last updated : 26/Aug/2017

Maybe you like living in Japan so much that you want to be able to stay permanently. To do this, if you are a foreign national, you will need a Permanent Resident visa. In Japan, your residential visa type is shown on your Resident Card. The Permanent Residency visa allows unlimited duration for your stay in Japan. However, you must still renew your Resident Card, every 7 years, but this process is simple. Unlike other visas, once a Permanent Resident visa is granted, you no longer face restrictions in your employment or other activities.

[quads id=3]

If you are an ordinary visa holder, you may apply for a Permanent Resident visa after you have lived in Japan for 10 years or more.

If you have been approved as a Highly Skilled Professional (HSP), you may apply for Permanent Residency after 3 years from the date you were approved as an HSP. If your application for an HSP No.1 is assessed as having 80 points or more, you can apply for Permanent Residency in 1 year. The time you lived in Japan before getting the status of an HSP does not count towards meeting this 3 years residency requirement as an HSP. For example, if you were approved as an HSP after living in Japan for 2 years, this period prior to being approved as an HSP would not be included in the 3 years of residency required before a Permanent Residency application can be made.

If you are the spouse of a Japanese national, you can apply for Permanent Residency after 3 years.

It can be difficult to get approval for Permanent Residency if:

- you have not been paying taxes (not only the national tax but also residential tax),

- you are unable to obtain your tax certificates,

- you have not been paying the social security health care levy or pension levy, or

- you have other problems such as a minor traffic offence.

Your payment record of the taxes and social insurance premium is particularly important.

Sometimes your financial situation can affect your application. For example, recent cases have required a minimum annual income threshold of 3.3 million yen for a single person, 4 million yen for a couple and 4.5 million yen for a couple with a child.

Further, if you have changed your job in the past, it is now required that you report about your employment changes to the Immigration Bureau when you make an application for Permanent Residency.

Contents

Things to note after you are approved as a Permanent Resident

In Japan, all residential visas are issued as in the form of a Resident Card that specifies the visa status.

When you obtain a Resident Card for the first time, you need to register your address at your local municipality office in Japan as defined by the Residential Basic Book Act. If you move, you must re-register at your new address. Your personal information will be transferred online from the Immigration Bureau of Japan to your local municipality office.

Once you are approved for Permanent Residency, you will be issued a Resident Card that shows your status as a Permanent Resident. If you already have a Resident Card with a different status, you will exchange the old Resident Card for the new Resident Card.

If you have been away from Japan for 6 years or more since you received your Permanent Residency, your Permanent Resident status may be revoked. As a principle, you must make sure that you have at least 6 years of valid residential registration in Japan during the 7 years’ renewal period.

If you commit any crime, including tax offences, you can be subject to Forcible Deportation. Your Permanent Resident status may become void in these circumstances.

One thing to note is that if you are considering bringing your parents from overseas, HSP No.2 visa may make things easier for you than the Permanent Resident visa. If you are HSP assessed, you become HSP No.1 first and after being HSP No.1 for 3 years you can become HSP No.2.

Make sure to obtain a Re-entry Permit if you may be staying outside Japan for over 1 year. If you stay outside Japan for more than 1 year without a Re-entry Permit, your Permanent Resident status becomes void.

What happens if your Japanese spouse passes away? What happens if you get a divorce? In these cases, there is no change to your Permanent Residency status.

How to Apply for Permanent Residency

The Immigration Bureau has a rigorous process if you want to apply for Permanent Residency.

First, you will need an Application form for Permanent Residency. You will also need a document that describes the reason for your application for Permanent Residency in Japan. This must be written in the Japanese language. You may submit supplements such as photos of yourself at work and with your family. It is better to have as much information as possible to support your application.

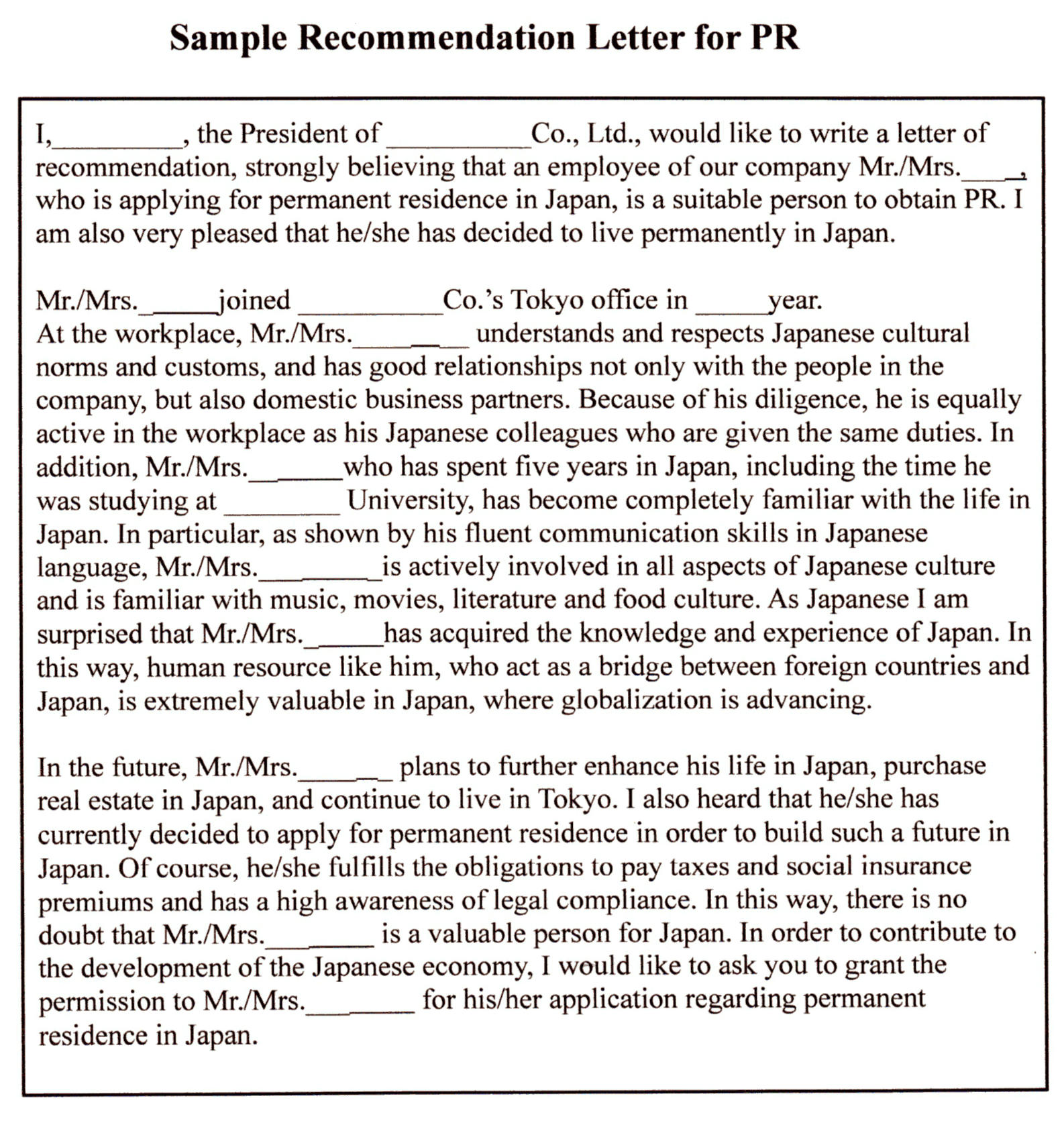

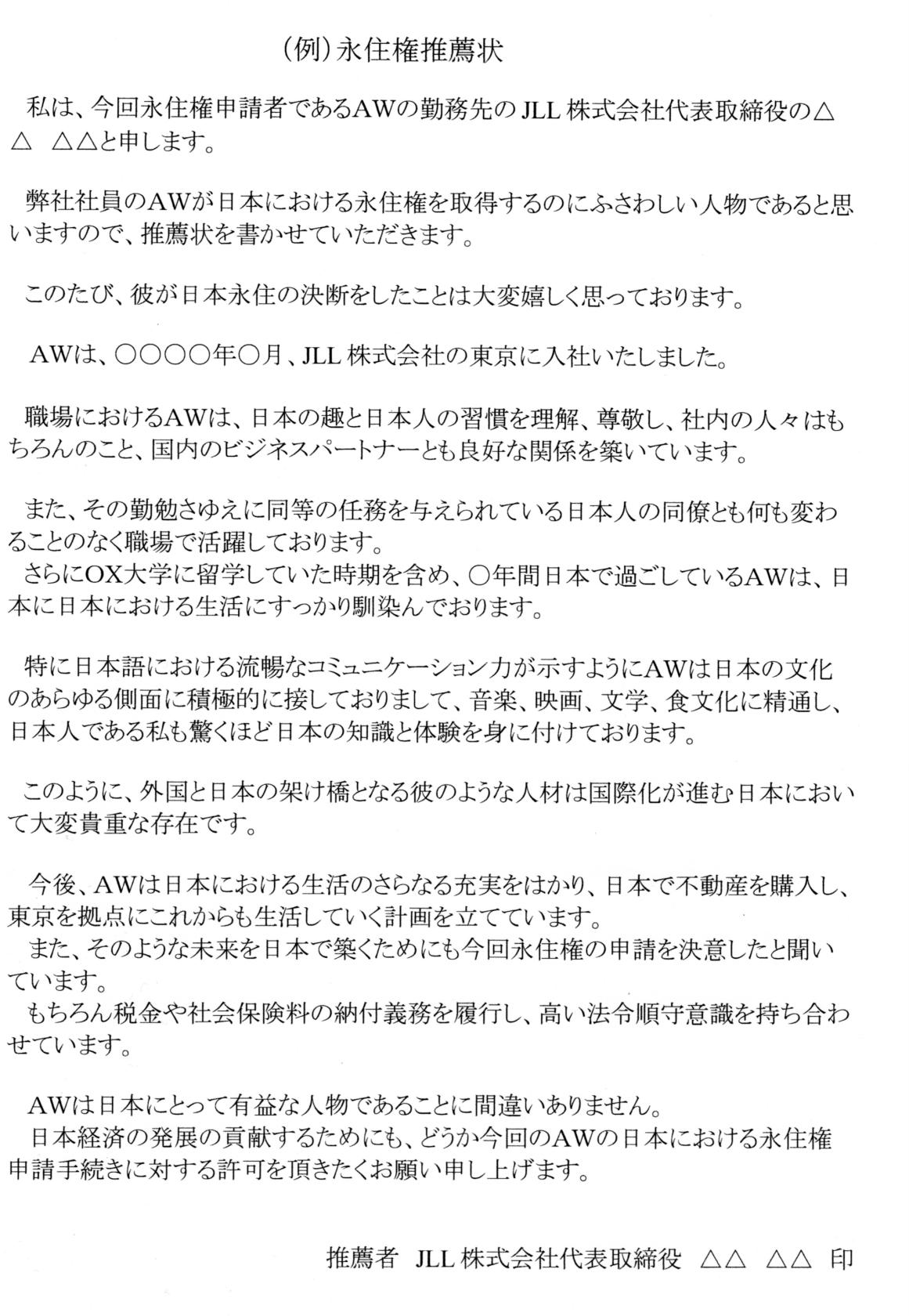

For your personal identification, you will need various certificates such as your family register, your birth certificate, and your marriage certificate. In addition, you must provide your Certificate of Residence. To further your application, recommendation letters from companies and universities can be beneficial.

You will also need the documents to certify your social status and means of financial support, as follows: if you are an employee of a company, you will need your employment certificate; if you are a company executive, you will need a certified copy of the corporate register; if you are self-employed, you will need a copy of your final tax return and statements of payments of national pension and national health insurance. As a proof of income, you will need a withholding tax allowance certificate. A self-employed person needs a certificate of tax payment. You will need to provide a certificate of your bank account balance or your actual bank account book and a copy. If you own any real estate, you will need certified copies of the real estate register as well. You will also need a certificate of residential tax payment, because a tax payment record as a resident in Japan is one of the assessment criteria for a Permanent Resident visa. Regarding your Japanese Pension levy payment record, you can use the internet system called “nenkin net” (https://www.nenkin.go.jp/n_net/) to obtain a printed copy of your payment record.

Many applicants for Permanent Residency have difficulty obtaining a personal reference from a guarantor. This is required as part of the application. Your guarantor must be a Japanese national or a permanent resident in Japan. Your guarantor’s occupation certificate, income certificate, and Certificate of Residence will be required as well as the guarantee document.

If you have received a decoration for bravery or distinguished services, or a certificate of commendation from a local government or the national government of Japan, then you should submit certified copies of them. You may also submit any proof of your activity as a volunteer.

The possibility of obtaining a Permanent Resident visa improves with thorough preparation and submission of the above documents with the application form.

As previously mentioned, some recent cases showed the financial requirements for approvals: minimum annual income of 3.3 million yen for a single person, 4 million yen for a couple and 4.5 million yen for a couple with a child. Paying tax and having an occupation with a stable income is one of the key aspects towards approval.

If your current visa is likely to lapse before your Permanent Residency assessment is completed, make sure you apply for your visa extension before the expiry of your current visa.

My Number System and the Permanent Resident visa

The My Number System started in 2016 and will affect foreign nationals as well as Japanese nationals. Even if you hold Permanent Resident visa, if you do not have Certificate of Residence in Japan, you will not be issued your My Number. For people who register their address in Japan now, everybody is issued their own My Number. However, if you were living in Japan before the system started, you may not have your own My Number issued yet. This system allows tax payment records of Permanent Resident visa holders like other My Number holders to become easily accessed by the immigration authority. You may jeopardise your visa renewal if there is no record of issuance of your My Number and tax payments. Also, the My Number System will allow the authority to check the payment records for the national pension system and premiums for national health insurance. As mentioned before, lack of pension and health insurance payments can also place the renewal of your Permanent visa into jeopardy.

From July 1, 2019, the requirements for permanent residence of foreigners with the status of residence of “Engineer/Specialist in Humanities/International Services” and “Specified Skilled Worker” have become stricter.

Seven years have passed since the residence card system started in July 2019. As a result, the requirements for PR application have also been revised.

The specific content of the review is that the requirements for permanent residence of foreigners with the status of residence of “Engineer/Specialist in Humanities/International Services” and “Specified Skilled Worker” have become stricter, and the number of documents to be submitted for the application has increased, hence the process became even stringent.

Particularly in the case of non-payment or late payment of Taxes, Pension premiums, and Health Insurance Premiums, the probability of rejection has become higher.

The basic documents to be submitted are as follows.

1.PR permit application

2.Photo (3 x 4 cm)

3.Reasons (written in Japanese)

4.If the visa status of family members is a “family stay”, the following certificates are required

(1) One copy of Family register (Koseki Tohon) (certificate of all records)

(2) One copy of Birth certificate

(3) One copy of Marriage certificate

(4) One copy of Certificate of items stated in the acceptance of acknowledgement

(5) Similar to (1) to (4) above

5.Residential Certificate (Juminhyo) for all the family members (household) including the applicant (My Number should not be mentioned)

6. One of the following documents certifying the applicant’s (or the person who supports the applicant) employment status

(1) In case of working at a company, Employment Certificate

(2) In case of self-employment,

a. A copy of the Tax Return

b. A copy of the Business Permit (if available)

(3) In other cases

Occupational description

7. Documents certifying the status of Income and Tax payment of both the applicant as well as his / her dependents (for the last 5 years).

(1) Documents certifying the status of Residence tax payment.

1 Certificate of taxation (non-taxation) and tax payment certificate of Residence tax for the last 5 years (in which the total annual income and tax payment status is mentioned), 1 copy each

#if you have a Certificate describing both the total annual income and tax payment status (stating whether the tax had been paid or not), then either one is acceptable.

2 Documents certifying the timely payment of Residence tax in the last 5 years. (copies of passbook, receipts, etc. will be the certifying documents)

(2) Documents certifying the National tax payment status

Tax Payment Certificate (Part 3) of Withholding Tax and Special Income Tax for Reconstruction, Self-assessed Income Tax and Special Income Tax for Reconstruction, Consumption Tax and Local Consumption Tax, Inheritance Tax, and Gift Tax.

#The tax payment certificate (part 3) proves that there is no non-payment on the requested date or at present for which the certification is to be obtained. Therefore, it is not necessary to specify the target period.

(3) Apart from that, the applicant’s Income proof is required.

1 .Copy of saving account passbook

2 .Other materials that can prove the Income

8. Documents certifying the applicant’s (or the person who supports the applicant) Public Pension premiums and Public Health Insurance premiums’ payment status.

(1) Documents certifying the Public Pension premiums (for the last two years) payment status.

1 “Pension Notification” (with Pension Record Information for the entire period.)

#The submission of Postcard type of “Pension Notification”, which is sent every year on your birthday, is not accepted as a relevant documentation, since the entire period cannot be confirmed.

2 Print screen of “Monthly Pension Record” on Nenkin Net

#Registration for Nenkin Net can be done at the homepage of the Japan Pension Service.

https://www.nenkin.go.jp/

For those applicants who have been enrolled in the National Pension System for the last two years at the moment of the application for a PR permit, they also have to print out and submit the print screen of the “pension record for the national pension (payment status of each month)” in the “Monthly pension record”. In addition, if there is any failure to pay, or late payment, it will be difficult to obtain the permanent residence.

3 National Pension Insurance premium receipt (copy)

#The applicants who have been enrolled in the National Pension System for the last 2 years must submit the National Pension Insurance premium’s receipts to prove their payments.

#The applicants who have been enrolled in the National Pension System (for the entire period, for the last 2 years) and who can submit a copy of the National Pension Insurance Premium receipt for the last 2 years (24 months), are required to submit the print screen of “Pension Notification of 1 and “Monthly Pension Record” of Nenkin-Net of 2.

(2) Documents certifying the latest Public Health Insurance premiums payment status (for the last two years).

1 National Health Insurance Certificate of Card (copy)

This is only for the applicants who are currently enrolled in National Health Insurance System.

2 Health Insurance Card (copy)

This is only for the applicants who are currently enrolled in the Health Insurance System.

3 National Health Insurance premium (tax) payment certificate

A proof of payment is also required for the applicants enrolled in the National Health Insurance during the last two years.

4 National Health Insurance premium (tax) receipt (copy)

If the applicant has been enrolled in the National Health Insurance during the last two years, he/she must submit the copies of all the receipts for those two years. If he/she cannot submit them, then he/she has to write a letter explaining the reasons why he/she cannot submit them.

(3) When an applicant is an owner of a business entity eligible for social insurance at the time of application.

If the PR applicant is an owner of a business entity eligible for social insurance, he/she has to submit the “Documents certifying the Public Pension Insurance Premiums payment status” and “Documents certifying the Public Health Insurance Premiums payment status “. In addition, it is necessary to submit either (1) or (2) documents regarding the Public Pension and Public Health Insurance premiums at the business entity for the period of being the business owner of a business entity for the last two years.

1 Health insurance, Welfare Insurance premiums receipt

The applicant is required to submit the copies of the receipts for the entire period of the last two years as a business owner.

2 Social Insurance Premium payment confirmation (application) form

The “Social Insurance Premium payment confirmation (application) form” (for confirming the payments status) can be found on the Japan Pension Service’s homepage

https://www.nenkin.go.jp/service/kounen/jigyonushi/sonota/20140311.html

9. Any document certifying the applicant’s (or the person supporting the applicant) assets.

1 Copy of bank passbook

2 Real estate registration certificate

3 Certification documents equivalent to (1) and (2)

10. Passport

11. Residence Card

12. Personal Reference

The Guarantor must be a Japanese person or a permanent resident.

The Guarantor needs to provide the following documents.

1 Documents certifying his /her occupation

2 His/ her Income certificate for the last 1 year

3 Residential Certificate

13. Documents certifying the applicant’s contribution to the Japanese society?

1 Certificate of commendation or testimonial, Certificate of Appreciation, etc.

2 Recommendation letter written by the representative of the affiliated company

3 Certificate of volunteer activities in Japan

4 Materials certifying the contribution to Japan in his/her field of work, presentations at academic conferences, patent documents acquisition, writing books, etc.

14. Other

Even if the applicant is employed, or married to a Japanese person, he/ she will be required to submit his/her Family Registration?

The above mentioned documents are just the basic explanatory documents. In addition to these, there are some other optional documents that can be submitted.

Permanent Residence Application for Highly Skilled Professionals

For a highly skilled professionals’ PR application, the applicant must prove that he/she has met the required number of years of points in addition to the required documents for a regular application for permanent residence.

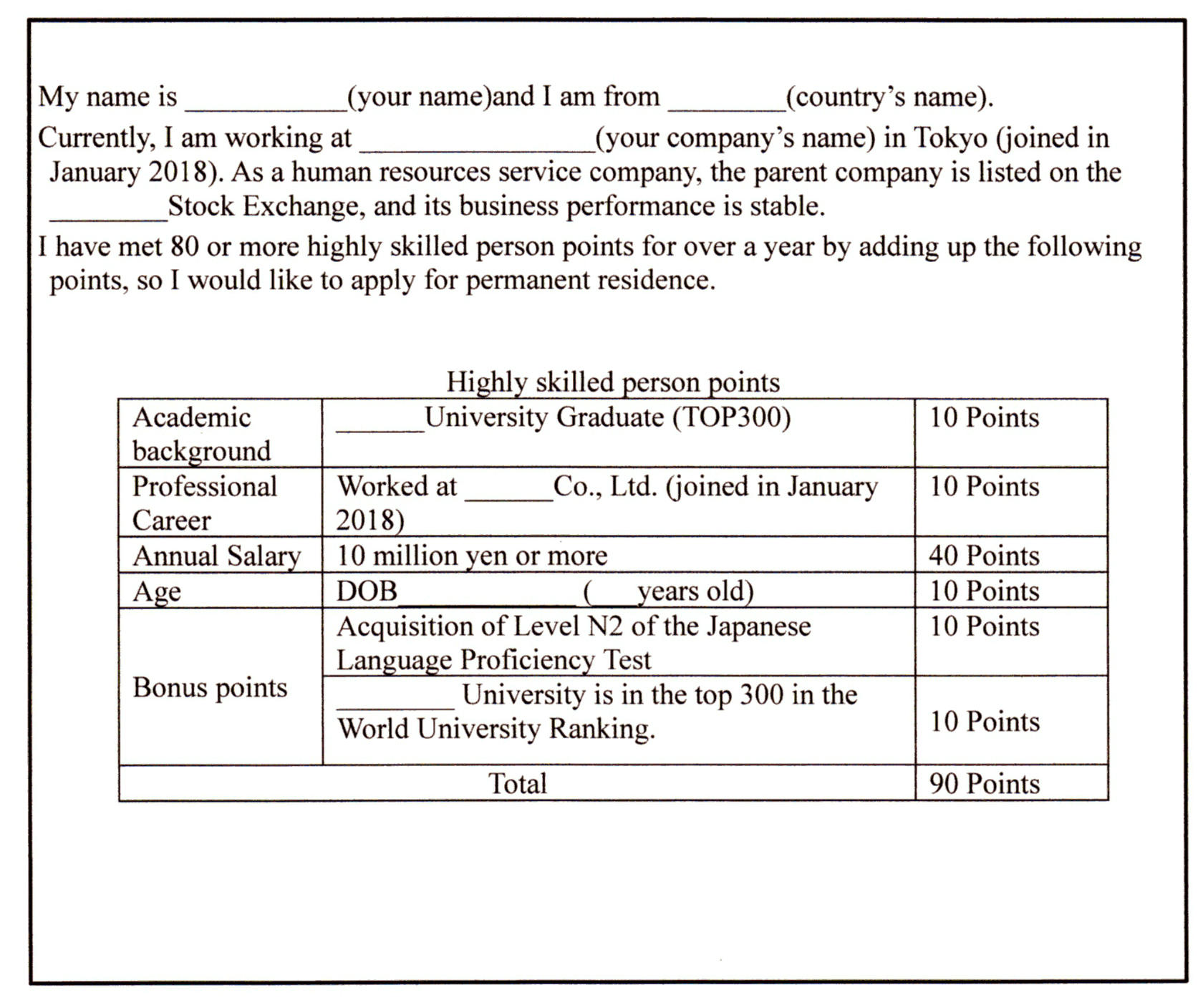

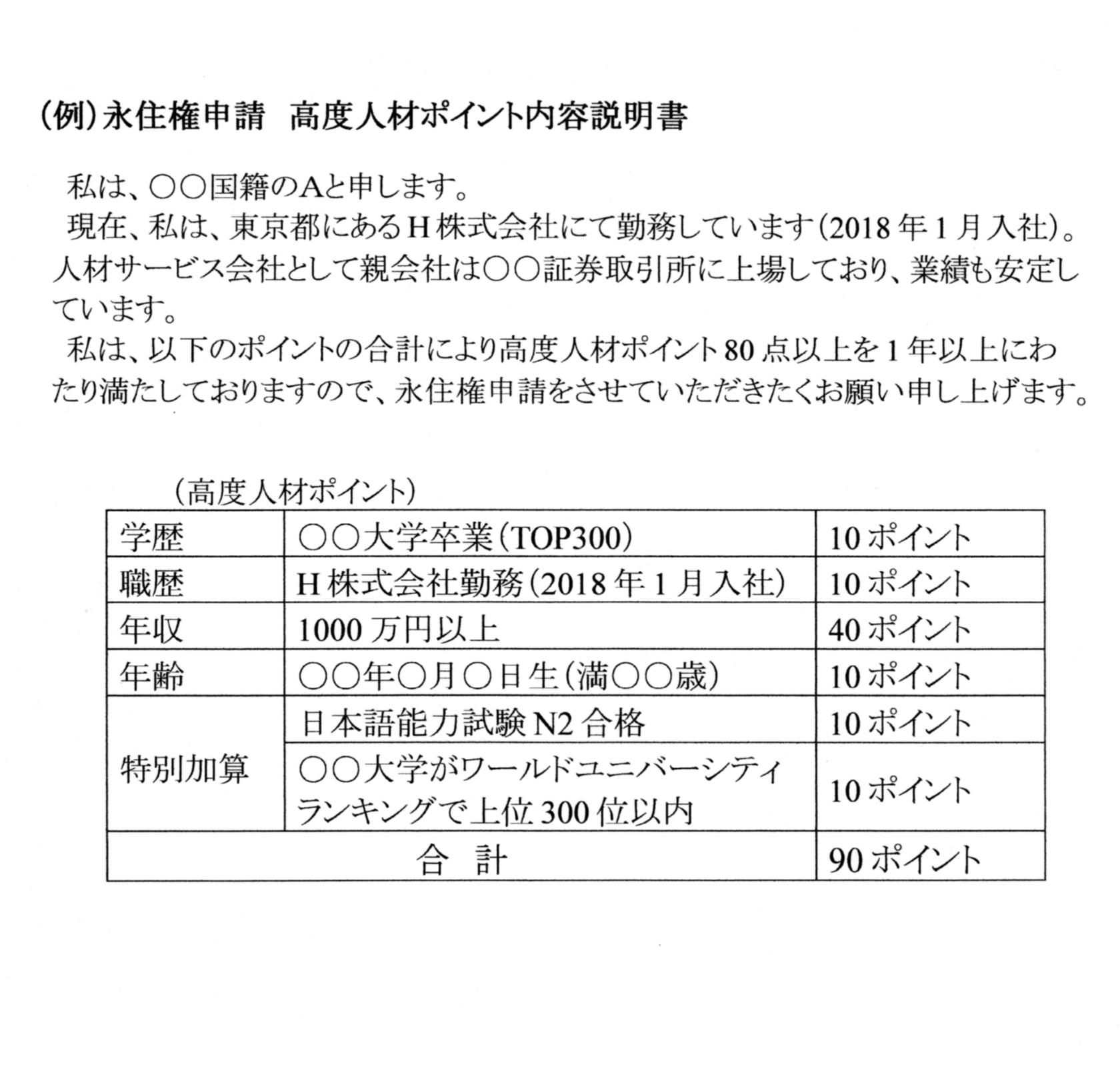

Q:What kind of Cover Letter should be prepared when a highly skilled foreign professional (90 points) applies for permanent residence?

A:When applying for permanent residence, it is recommended to prepare a Cover Letter following the format below.

Even if you have a status of residence of a highly-skilled professional, the preferential treatment is given only for the period of stay in Japan. If there are irregularities in the payment of taxes or pension premiums, the path to obtain a permanent resident visa will be blocked. You need to understand this fact carefully.

The period of stay of highly-skilled person required for permanent residence is one year for 80 points or more, and three years for 70 points or more.

Permanent residence requires the submission of a wide range of documents.

We recommend you to have sufficient preparation time for your application.

Additional documents for PR application

In order to obtain permission for permanent residence application, there are some additional documents that should be submitted voluntarily. For example, a proof that the applicant have contributed to Japanese society by participating in volunteer activities, or recommendation letters from your Japanese spouse or the President/CEO of a company that supports the PR application, are said to have impact.

Additional documents for PR application

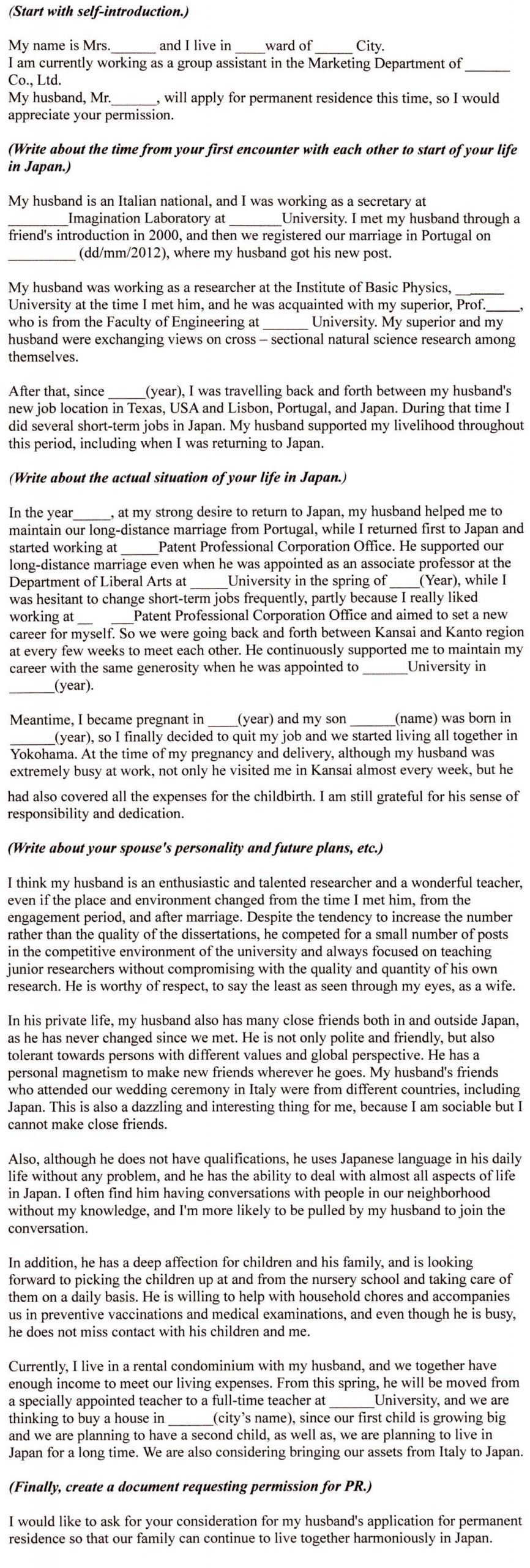

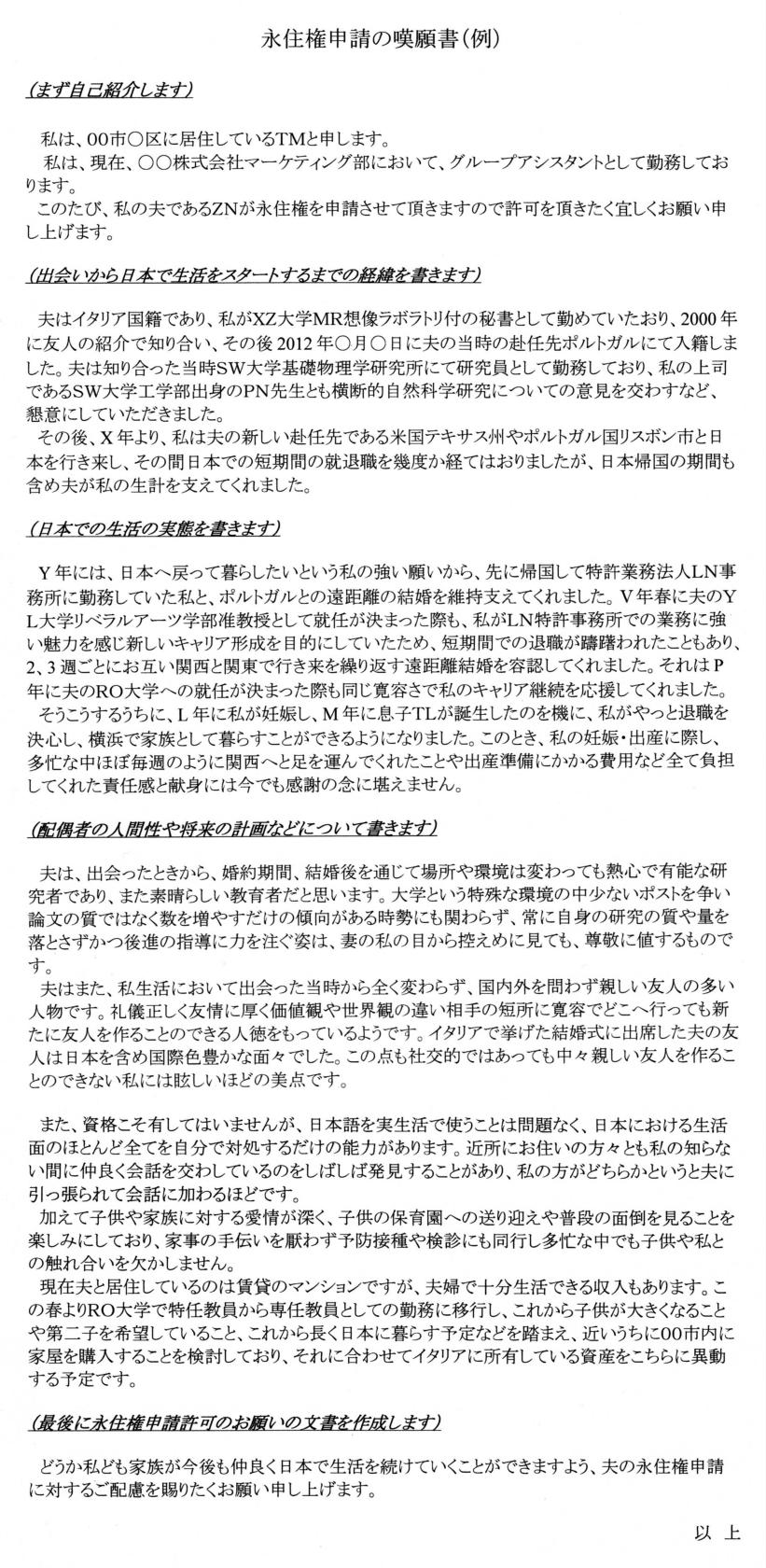

Here is an example of an applicant’s petition for permanent residence written by the applicant’s wife.

The following are the points to be included in a petition for PR application. It should contain the facts from the encounter to the present days, with the details that can be easily understood by the examiner.

Points of recent screenings of PR and the way to obtain the PR permit.

Recently, the number of applications for permanent residence has increased, and the screening standards have become stricter since July 2019. It is not possible to obtain PR permit unless you meet the absolute standards for the annual income and pension. It is important to enroll in Japanese Pension System, to pay pension premiums for at least the past two years (with some exceptions), to have an annual income equivalent to that of Japanese people, and to pay income tax, resident tax and other taxes without any delay.

One of the major reasons why foreigners are currently denied permission for permanent residence is that they have not enrolled themselves in the Japanese Pension System or have not paid their pension premiums. The application will be rejected even if the Japanese spouse of the applicant failed to pay any his/her own pension premiums.

Q:I am a freelance foreigner who is enrolled in national pension system. It seems that I need to submit a proof of national pension to apply for permanent residence. What exactly is this proof?

A:Sole proprietors, etc. are required to enroll in National Pension System. Currently, the Immigration Bureau of Japan accepts the submission of following three types: “Insured Person’s Record Inquiry Answer Sheet for Pension Records” and “Payment I” and “Payment II” of “Insured Person’s Record Inquiry.”

The “Insured Person’s Record Inquiry Answer Sheet” is a printed document indicating the information about the enrollment system, qualification acquisition date, qualification loss date, and enrollment months.

If you are enrolled in the welfare pension system, the name of your work place is also mentioned, but if you are a freelancer, only the national pension is mentioned.

On the “Payment I” document, data on the payment date is mentioned as to whether or not the national pension premiums have been paid by the set payment deadline. In the case of foreigners, there are cases where they pay at convenience stores, etc. every time an invoice arrives without using bank transfer. In case of paying at the convenience stores, there may be delays in payment due to the applicant’s busy work schedule. A serious problem arises when the payment deadline is overdue. Since the delay does not comply with the National Pension Law, the screening can result in the rejection of the PR application.

There was a case of an Indian family that applied for permanent residence, and the husband was enrolled in Employees’ Pension Insurance System and the wife was enrolled National Pension System. The wife paid all the premiums, but she missed the payment deadline three times. The husband had no problem at all, but due to his wife’s delay in paying the national pension insurance premium, the PR application was rejected.

“Payment II” document is used to check whether the applicant have paid all the resident pension insurance premiums for the past two years. If there is any period of non-payment in the last two years for no good reason, this might reject the PR application. The Immigration Bureau of Japan will also ask for a certificate of National Health Insurance premiums. In that case, the applicant should submit a certificate of national health insurance premium payment, etc. issued by the municipality that clarifies that the insurance premium has been paid in full.

Point 2. Promptly respond to request of the examiners to submit additional documents necessary for the PR application.

A recent trend is that a few months after submitting the PR application, an Immigration Bureau examiner would send a mail requesting additional documents. If the applicant fails to submit those required additional documents, it is more likely that the application would be rejected.

Q:When applying for permanent residence, the applicant might need to submit additional documents. What is required to submit for a foreigner who has a Japanese spouse?

A:The following documents may be requested by the examiner of the Immigration Bureau of Japan.

Family register(Koseki Tohon) of Japanese spouse, birth certificate (certificate of acceptance of the birth certificate) marriage certificate(Kon-in Todoke)

Residential Certificate (Juminhyo)for all applicant households (no omission other than My Number)

Documents certifying occupations of (applicant, husband, wife, father, mother, etc.)

Certificate of employment (with the date of hiring)

Certificate of student status

Certificate of full registry records of the company the applicant runs.

A copy of the tax return (the year is specified and it is required to submit a copy of Tables 1 and 2.)

Documents certifying the income of the (applicant, husband, wife, father, mother)

Resident Tax declaration certificate

The latest year version of the Resident Tax Payment Certificate (obtained at the municipal office)

Documents on the National Tax payment status of the (applicant, husband, wife, father, mother). Tax Payment Certificate (Part 3) of Withholding Tax and Special Income Tax for Reconstruction, Self-assessed Income Tax and Special Income Tax for Reconstruction, Inheritance Tax, Gift Tax (issued by the relevant tax office which certifies that all taxes are paid correctly.)

A copy of the health insurance card of the entire household

A copy of the head of household’s National Health Insurance Tax “Certificate of Tax Payment” and “Receipt of Payment”. The year is specified. It is not required if all the members of household are enrolled in social insurance during the specified period.

“Insured Person’s Record Inquiry Answer Sheet” and Insured Person’s Record Inquiry (Payment I and Payment II) related to the Pension Record of the (applicant, husband, wife, father, mother). The set of these 3 documents is required to be submitted on a household basis. These documents will be issued by your local pension office.

Residential Certificate for all households of guarantor, proof of occupation and proof of income for the last year

The examiner may request other materials at his discretion.

Point 3. Apply when the annual income requirement is fulfilled.

Regarding the annual income requirement for foreigners, the standard has become stricter as the former Prime Minister announced in the Diet that foreigners who do not have an average annual income level equivalent to that of Japanese will not be granted permanent residence. For foreigners who are married, their income in Japan is mentioned on the tax certificate of residence tax and that is a proof of income.

Q: Are there any income requirements for foreigners applying for permanent residence?

A:There are livelihood sustainability requirements for foreigners applying for Permanent Residence. Previously, if an applicant stayed in Japan for 10 years, he/she could get a PR permit even if his/her income was in the 3 million yen range. From 2019, the income level required to obtain the PR was set higher.

Now, it is required to reach the average annual income level of Japanese people. It seems that the minimum annual income requirement is decided every year from January to April based on the data of the statistical survey.

The average annual income over Japan varies from city to city, but according to the National Tax Agency’s survey of salaries in private companies, the average annual income is around 4.2 million to 4.4 million yen. The numerical value of this index is an important factor in judging whether a foreigner who applied for PR has an annual income equivalent to that of average Japanese, and if it does not exceed this index, the application may be rejected.

However, when applying for permanent residence as a couple, if the spouse is Japanese, the total annual income of the household will be examined, so this value will change.

Currently, in the case of a family of four (a couple and two children), it is necessary to provide proofs (such as a certificate of residence tax) of annual income of at least 5 million yen.

As the number of foreigners seeking permanent residence has increased, it is expected that the annual income requirement will become even stringent in the future.

Even if the annual income is high, if the applicant has four or more dependents, his/her tax payment will be low and that could become a reason of rejection.

Another factor for rejection is the case where the spouse does not comply with dependent visa status which allows only 28 hrs. work/week, is engaged in activities not allowed by the status of residence, or works full-time. The amount stated in the tax certificate of residence tax will immediately reveal any violations.

Point 4. Do not leave Japan for a long time after applying for PR

A blind spot that foreigners do not understand is leaving Japan after applying for PR. If an applicant leaves Japan longer than 6 months, the application will be rejected due to the absence. Even a brilliant foreigner with 90 or more points for a highly skilled profession may be rejected just because he/she spends a lot of time on overseas projects and has a short stay in Japan. Even if the applicant stayed in Japan before submitting the PR application and has a track record up to that moment, if he/she leaves Japan during the period of PR screening, the result will be unfavorable.

Point 5. Do not create any trouble in Japan during the PR screening period

There are cases where foreigners quarrel with Japanese people and cause violence for small reasons, or they drive on holidays and get a red ticket for over speeding which counts as a criminal record. If such an act occurs during the PR screening period, the application will almost certainly be rejected.

Point 6. Promptly inform the Immigration Bureau when you change your job or your residential address.

When you change your job or when you move to a new location after submitting the PR application, inform the PR screening department of Immigration Bureau of Japan.

After moving to a new location, please submit a new certified copy of resident register (Juminhyo). If you change your job, do not fail to submit a “Notification Regarding Contracting Agency” otherwise the application might be rejected. Even if you work at the same place, if the type of contract changes from an employment contract to an outsourcing agreement, you must also submit a “Notification Regarding Contracting Agency”.

Q: What kind of documents are required if a foreigner changes job during PR application screening? In addition, this foreigner, who works under an outsourcing agreement, is also moving to a new location due to the job change.

A: Required documents

Certificate of employment in a new company

New Residential Certificate (Juminhyo)

Tax Payment Certificate (Part 3) of Withholding Tax and Special Income Tax for Reconstruction, Self-assessed Income Tax and Special Income Tax for Reconstruction, Consumption Tax and Local Consumption Tax, Inheritance Tax, Gift Tax.

A copy of the Health Insurance Card used after a job change.

Print screen of “Monthly Pension Record” on Nenkin Net or Pension Notification (with Pension Record Information for the entire period. Postcard type of “Pension Notification” is not acceptable.)

National Pension Insurance Premium Receipt (copy) (Required only for those who have been enrolled in the National Pension System in the last one year from the date of change of job.

The applicant must prepare and submit the documents in such detailed manner.

Need Help?

The approval process for the Permanent Resident visa has stringent criteria that many will find overwhelming without assistance. However, once you are approved as a Permanent Resident, you will be spared the cumbersome task of applying for changes to your visa type and duration.

Our firm, the office of Masami Sato, “gyoseishoshi Sato Masami jimusho”, has solicitors that specialise in visa matters. Contact Us for any enquiries regarding Permanent Residency in Japan. http://www.tokyoimmigration.jp/eng/annai.html

Through another Masami Sato office, we can advise you about pension systems and social insurance matters. Contact us if you wish to receive support from the labour and social security attorneys in our office of “shakai hoken romushi Tokyo kokusai jimusho“.